Enjoy that executive suite in Hell, buddy!

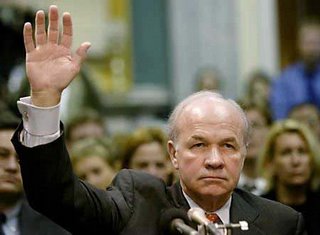

Ken Lay, the dishonored founder of Enron whose deceit and double dealings cost 4,000 employees their jobs, and many of them their entire life savings, died of a massive coronary this morning.

I know some of you think that this heart attack is cause for celebration. I don’t. I think that the sweet release of death is too good for this disgraced, fraudulent scoundrel. I would have preferred a nice, lengthy jail term, let’s say about forty years. Besides, a heart attack is not a moral indictment. There are plenty of benevolent people who die of heart attacks. I know at least five people who have lived pretty decent lives and suffered the same fate as Lay. And when their turn came to meet their maker, they weren’t relaxing in one of their vacation homes or receiving the best medical care that money can buy.

In fact, I wonder how many former Enron employees have died, or seen a sharp decline in their health as a direct result of losing their jobs and their savings. I wonder how many of them will have to sit through the inevitable eulogies that try to make this asshole look like a tragic figure who, like Oedipus, was simply overcome by his circumstances. Lest you think I exaggerate, I offer you proof that some have already begun the post mortem exoneration process. From Bloomberg: “Lay's death robs his family of any chance to proceed with his appeal to attempt to clear his name by reversing the conviction,” said Houston defense attorney Joel Androphy, who followed the trial. “Legally, he may have gotten his good name back, but publicly he did not,'' he said. “People will view this as the ultimate sentence.”

So now you see where this is headed. If Kenneth Lay had murdered two or three people in cold blood, no one would be describing him, like Ben Richardson of the BBC, as a “fallen hero.” He would be accurately depicted as a piece of garbage. But Lay didn’t get his hands dirty. He simply ruined the futures of thousands of people and was fortunate enough to not have to spend one single day in prison because of it. Let’s not allow the media to turn this guy into Achilles.

Labels: Crookery

4 Comments:

You hit the nail on the head, now let's see what happens to Skilling. There are those who believe that Lay might have taken his own life which would surprise me because if so why didn't he "exit" sooner in the game.

I'm having the hardest time not believing that he killed himself, as well. Apparently, the court had moved on Friday to seize $183M from Skilling and Lay, but since his death moots the issue of his sentencing, they're now saying Lay's assets are probably not touchable. Plus, there's all that insurance money. Hell, maybe his family killed him. I'm disappointed at least, and disgusted for sure. They should stick his head on a pike somewhere--maybe at the front door of the building where his full-floor luxury apartment was.

I agree in part with a lot of what you said and the theme has been reverberated here. Death by natural causes was and is too simplistic an end to a scandalous and unscrupulous person. However I have always been taught “judge not lest ye be judged…” But I have to ask would I want him to continue to rape and pillage the system by spending the next 40+ years of my tax dollars keeping him alive in a federal penitentiary? I think not… Unfortunately, there is no sweet repast in any direction whether using rose colored glasses or the clearest contact lenses.

I must offer the following as a financial professional in the arena if personal investments & corporate bankruptcy. What caused the masses of Enron, Worldcom, & Global Crossing employees to loose their proverbial life savings was one word “Greed”. Putting all of their eggs in one basket & placing all of their trust in the company. Simply Put There is no such thing as a sustained 20 year 20% rate of return. Alan Greenspan coined the term “Investor Irrational Exuberance” basically putting 80 – 100% of your retirement in company stock is insane. I have no remorse for the Greedy, Shut-up and continue to work…

I worked the 1st largest bankruptcy in history… Worldcom as a consulting auditor and I can honestly say the worry was not on the faces of the people that got let go because of the fraud (they knew what they had to do…). The worry was on the face of the people that had to stay and clean up the mess, to later find out that pay cuts, the sale of the company, & the eventual layoff was the payoff for all of their late nights (The got no jump on job market )

So goes the headliner of the 2nd largest Bankruptcy in History (1st is Worldcom)

Keep up the good work

» » »

Post a Comment

Subscribe to Post Comments [Atom]

<< Home